Understanding Cryptocurrency Market Microstructure

Market microstructure examines the mechanisms through which assets are traded and prices are formed. In cryptocurrency exchanges, understanding order book dynamics, liquidity provision, and transaction costs is essential for algorithmic traders seeking to optimize execution and identify profitable opportunities. The decentralized and fragmented nature of crypto markets creates unique microstructure characteristics distinct from traditional financial markets.

Order Book Dynamics

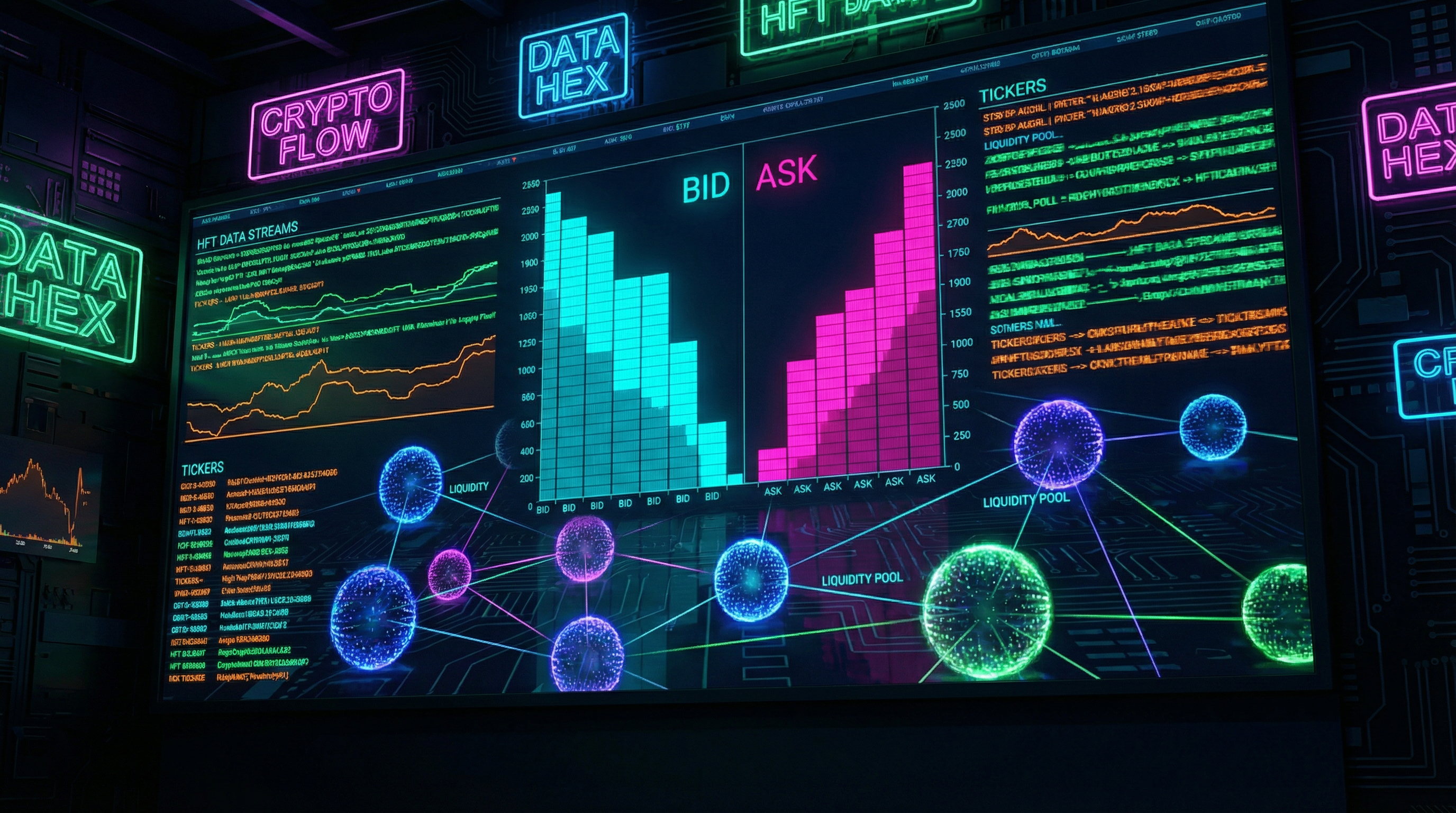

The limit order book represents the foundation of price discovery in cryptocurrency exchanges. It aggregates all outstanding buy and sell orders at various price levels, creating a real-time snapshot of market supply and demand. Level 2 data reveals the depth of liquidity at each price point, while level 3 data exposes individual order identities for detecting strategic behavior.

Order book imbalance—the ratio of bid to ask volume—provides predictive signals for short-term price movements. When buy orders significantly outweigh sell orders at the top of the book, upward price pressure typically follows. Sophisticated traders monitor order book slopes, measuring how quickly liquidity depletes as prices move away from the midpoint, to assess market resilience and potential slippage.

Hidden orders and iceberg orders complicate order book analysis. Large traders conceal their true intentions by displaying only small portions of their orders, replenishing as fills occur. This behavior creates apparent liquidity that disappears upon execution, challenging algorithms that rely on visible book depth for execution decisions.

Liquidity Provision and Market Making

Market makers provide liquidity by simultaneously posting buy and sell orders, profiting from the bid-ask spread while facilitating trading for other participants. In cryptocurrency markets, automated market makers dominate liquidity provision, continuously adjusting quotes based on inventory positions, volatility, and adverse selection risk.

The bid-ask spread compensates market makers for inventory risk and adverse selection costs. Wider spreads appear during volatile periods when price uncertainty increases, or in less liquid instruments where inventory management becomes challenging. Algorithmic traders can infer market conditions from spread dynamics, using tight spreads as signals of stable, liquid markets conducive to execution.

Maker-taker fee structures incentivize liquidity provision through rebates for passive orders. This creates strategic considerations for execution algorithms: aggressive market orders pay fees and remove liquidity, while limit orders earn rebates but face execution uncertainty. Optimal strategies balance urgency against transaction costs, sometimes splitting orders between aggressive and passive components.

Price Formation and Information Flow

Prices in cryptocurrency markets form through the interaction of informed traders, noise traders, and market makers. Informed traders possess superior information or analytical capabilities, moving prices toward fundamental values. Noise traders create temporary mispricings through emotional or uninformed trading. Market makers bridge these groups while managing their own risk exposure.

Information propagates across cryptocurrency exchanges with varying speeds due to different user bases, fee structures, and technological capabilities. Large exchanges with deep liquidity typically lead price discovery, while smaller venues follow with slight delays. Arbitrageurs exploit these temporary divergences, simultaneously buying on lagging exchanges and selling on leading ones until prices converge.

Transaction costs significantly impact price formation efficiency. High fees create wider no-arbitrage bounds, allowing prices to diverge more before profitable arbitrage opportunities emerge. Low-latency traders with minimal transaction costs tighten these bounds, improving market efficiency but also increasing competition for alpha generation.

Implications for Algorithmic Trading

Understanding microstructure enables algorithmic traders to optimize execution quality. Smart order routing algorithms analyze order book depth across multiple exchanges, directing orders to venues offering best execution prices after accounting for fees and expected slippage. These systems continuously adapt to changing liquidity conditions, sometimes splitting large orders across venues to minimize market impact.

Execution algorithms exploit microstructure patterns to reduce costs. VWAP algorithms time order placement to match historical volume patterns, while implementation shortfall algorithms balance urgency against market impact. Advanced systems incorporate machine learning to predict short-term price movements from order book features, adjusting aggression dynamically.

Market making strategies require deep microstructure knowledge to manage inventory risk and adverse selection. Successful market makers adjust quotes based on order flow toxicity—the likelihood that incoming orders possess superior information. High toxicity periods warrant wider spreads and reduced position limits to protect against informed trading.